Compliance credits for EVs undergoing reduction

EPA standards meant to incentivize EV production are phasing out

By Peter DouglaS: Member, Electric Auto Association

Tesla Model 3 assembly line

Electric vehicles (EVs) play an important role helping automakers keep in compliance with the Environmental Protection Agency (EPA) emissions standards. The agency’s regulatory framework forces each automaker to maintain a positive balance in its bank of compliance credits, earning a credit surplus when its model year fleet outperforms its aggregate emissions target, and incurring a deficit when its fleet underperforms. The flexible credit trading system allows the use of banked credits from previous years, and credits can also be purchased from other automakers.

EVs generate copious credits because they do not produce tailpipe emissions and are not charged for their upstream emissions, scoring an automatic zero on their performance tests. They greatly improve the average performance of corporate fleets, providing surplus credits that can be purchased by automakers with underperforming fleets, and help the entire industry achieve compliance.

Less generous credit allocation

Up until 2019, the EPA used a production volume multiplier in the credit calculation formula to count each EV as two EVs. The generous multiplier was designed to incentivize the rapid development of zero emission powertrains, and the strategy has been very successful.

But that multiplier is currently undergoing phase-out, in keeping with the original rules. When the credits are calculated for 2020 fleets, each EV will count as 1.75 EVs. In 2021, each will count as 1.5 EVs. Starting in 2022, the multiplier will drop to 1.0, effectively ending the bonus. The multipliers for fuel cell vehicles and plug-in hybrids are also phasing out.

Automakers already struggling with standards

The phase-out of the production volume multiplier is occurring at a time when the overall stringency of the regulatory framework is increasing. In 2019, the majority of automakers failed to meet their greenhouse gas emission standards for the fourth year in a row. Nevertheless, 20 automakers were able to maintain a positive balance of compliance credits.

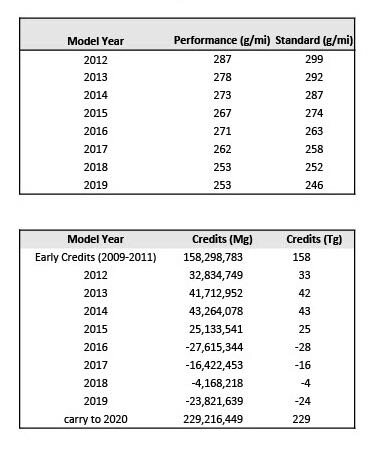

The table above shows how the various automakers performed against their 2019 standards, how many vehicles they sold, and the number of credits they gained or lost. Fourteen of the 20 automakers incurred a credit deficit in 2019. Credits represent actual carbon dioxide (CO2) emissions and are expressed as megagrams of CO2 (Mg = one million grams). Sometimes credits are rounded off and expressed as teragrams (Tg = one trillion grams).

To fully appreciate the large number of credits generated by EVs, it is helpful to compare Honda with Tesla. Honda generated 5,307,829 megagrams of credit in 2019 with an efficient, conventional fleet made up of 1.73 million vehicles, beating its standard by 15 grams per mile. Tesla’s much smaller electric fleet generated 11,070,481 megagrams of credit while selling just 125,538 vehicles, beating its standard by a whopping 450 grams per mile. The EPA’s credit market is especially lucrative for Tesla, which does not need any of its credits to achieve compliance and can sell them all to other automakers.

Sufficient credits have always been available for purchase

Figure 5.17 below shows how the available pool of credits has evolved over time. Total banked credits representing 229,216,449 million grams of CO2 were carried over into 2020, providing a fairly sizable cushion for the overall automotive industry. The 2019 deficit for all automakers of 23,821,639 megagrams was roughly one tenth of the credits available for purchase. Automakers were able to earn credits in the three years prior to the implementation of the 2012 regulations, banking 158,298,783 megagrams of credit during this helpful head start period.

Stringency of the regulatory framework is intensifying

Despite the current glut of banked credits, roughly two-thirds will expire in 2021. The EPA designed the credit trading system to provide flexibility to automakers, but the rules included a provision whereby banked credits earned after 2016 would expire after five years. Of the 229 teragrams of banked credits available at the end of 2019, 151 are now set to expire at the end of the 2021 model year. Honda, Chrysler, and Nissan each hold roughly 20 million megagrams of credit that will be forfeited if they remain unused. Toyota holds roughly 30 million.

The automotive industry has long been aware that the Corporate Average Fuel Economy (CAFE) standards negotiated by President Barak Obama’s EPA would tighten considerably in the final years of the program, scheduled to remain in effect through 2025. The stringency of the emission targets increase every year by 5%, maximizing compliance difficulty in the program’s final year. Its long-term effectiveness will depend on the fate of the rollback finalized by President Donald Trump’s EPA in 2020. If Trump’s more lenient Safer Affordable Fuel Efficient Vehicles standards survive legal challenges, stringency will only increase 1.5% each year beginning in 2021, severely undermining the ambitious goals of the CAFE framework.

Effects of the rule change hard to predict

The phase-out of the EV production volume multiplier will go forward no matter what becomes of Trump’s rollback, and it is worth pondering how the rule change will impact the sale of EVs. Automakers now appear determined to compete for market share in the emerging EV market, and many new fully electric models will be hitting showrooms over the next five years. It is quite possible that total EV sales will increase significantly on their own, continuing to generate plenty of surplus compliance credits even without the multiplier. A doubling of the EV adoption rate would completely offset the multiplier phase out.

If credits begin drying up, their scarcity will make them more valuable. This could increase the incentive for automakers to spend more to improve the efficiency of their internal combustion engine (ICE) models, but it is hard to see that happening. It is becoming very difficult to continue raising the fuel economy of ICE vehicles, particularly in a United States auto market that prizes jumbo vehicles with plenty of horsepower. Even if Trump’s rollback were to be overturned and the yearly stringency increases were to revert to 5%, the best compliance strategy would be to manufacture and sell more zero emission vehicles and hybrids, earning the compliance credits without the need to purchase them from other automakers.

EPA needs a new regulatory framework

The EPA’s regulatory framework has succeeded at incentivizing the development and proliferation of EVs, and it will continue to do that moving forward. But its ultimate objective was to reduce our excessive tailpipe emissions, and progress here has been disappointing. Obama’s EPA boasted that the CAFE standards would double fuel economy by 2025, but Page 79 of the Automotive Trends Report states that emissions from new vehicles have only improved 7% between 2012 and 2019. Gasoline consumption increased from 3.2 to 3.4 billion barrels annually during the same period.

As long as automakers can purchase credits to maintain compliance, EVs will continue to enable the sale of our largest, most inefficient ICE vehicles. It is time for a new regulatory framework similar to California’s that capitalizes on the success of EVs, phasing out the sale of vehicles powered by gasoline.